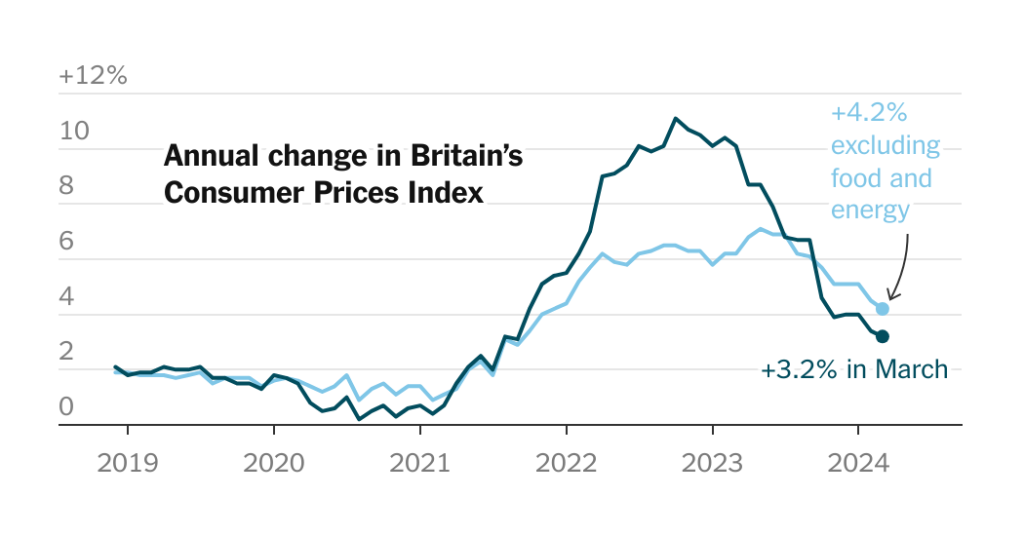

Consumer prices in Britain rose at a slower rate in March, with inflation at 3.2 percent, down from 3.4 percent in February but slightly higher than economists had predicted. This decrease was attributed to a drop in core inflation, which excludes volatile food and energy prices, from 4.5 percent to 4.2 percent. Economists anticipate that inflation will continue to decrease in the coming months, possibly falling below the Bank of England’s 2 percent target, as household energy bills decrease.

The weakening economy has put pressure on the Bank of England to lower interest rates, as seen by the rise in the country’s unemployment rate. This has created a challenging situation for the central bank, as slowing inflation suggests a need for rate cuts to stimulate economic growth, but policymakers may want more concrete evidence of sustained improvement before making such a move. Despite this pressure, the Bank of England has kept its key interest rate at 5.25 percent for the fifth consecutive meeting, with no immediate plans to cut rates.

Similarly, the U.S. Federal Reserve has also maintained its interest rates at recent meetings, as officials are hesitant to act in response to persistently high inflation levels. The Fed’s top officials have indicated a willingness to wait longer than initially expected before considering rate cuts. In contrast, the European Central Bank has hinted at a potential interest rate cut at its upcoming policy meeting in June, as inflation in the eurozone declines and the region’s economy struggles.

Overall, the cooling inflation in Britain, combined with the broader global economic challenges, highlights the delicate balancing act central banks are facing in deciding whether to adjust interest rates. While lower inflation rates could signal a need for rate cuts to stimulate economic activity, policymakers are cautious and may require more solid data before making any significant changes. The coming months will be critical for central banks as they navigate these uncertainties and strive to support economic growth and stability.